Ex-Nasdaq Chairman Arrested on $50B Fraud Charge

Bernard L. Madoff, chairman of Madoff Investment Securities is seen on his Manhattan trading floor in this photo taken Dec. 30, 1999 in New York. The former Nasdaq stock market chairman was arrested on a securities fraud charge Thursday, Dec. 11, 2008, accused of running a phony investment business that lost at least $50 billion and amounted to nothing more than a "giant Ponzi scheme." (AP Photo/The New York Times, Ruby Washington).

Bernard L. Madoff, chairman of Madoff Investment Securities is seen on his Manhattan trading floor in this photo taken Dec. 30, 1999 in New York. The former Nasdaq stock market chairman was arrested on a securities fraud charge Thursday, Dec. 11, 2008, accused of running a phony investment business that lost at least $50 billion and amounted to nothing more than a "giant Ponzi scheme." (AP Photo/The New York Times, Ruby Washington).

NEW YORK – A Wall Street powerbroker for nearly 50 years who built an influential firm has confessed to a massive fraud scheme that will cost investors at least $50 billion, federal authorities say.

Bernard L. Madoff, 70, facing a single count of securities fraud, declined to speak with reporters after a federal magistrate judge in U.S. District Court in Manhattan ordered him released Thursday night on $10 million bail.

Andrew M. Calamari, associate director of enforcement in the Securities and Exchange Commission's New York office, said the SEC had filed a civil securities fraud charge as well and was alleging "a stunning fraud that appears to be of epic proportions."

The SEC said it was seeking emergency relief for investors, including an asset freeze and the appointment of a receiver for the firm. A hearing was scheduled for Friday.

If the allegations contained in a criminal complaint are true, it may be the largest fraud ever blamed on a single individual. Nearly all of the allegations stem from an FBI agent's recounting of what Madoff told two FBI agents and three senior employees of his firm, Bernard L. Madoff Investment Securities LLC.

It would be a steep fall for Madoff, a former Nasdaq stock market chairman who founded his business in 1960 with $5,000 he earned in part working as a lifeguard on Long Island beaches.

His firm was a market maker, handling trades in some of the largest securities on various stock exchanges, matching buyers and sellers. Investigators say Madoff's crime originated in a separate and secretive investment-advising business that served between 11 and 25 clients and had a total of about $17.1 billion in assets under management.

The criminal complaint signed by FBI Agent Theodore Cacioppi said Madoff told at least three senior employees at his Manhattan apartment Wednesday that the investment adviser business was a fraud and had been insolvent for years, losing at least $50 billion.

Madoff told the employees he was "finished," that he had "absolutely nothing," that "it's all just one big lie" and it was "basically, a giant Ponzi scheme," according to the complaint filed in court.

The employees understood Madoff's admission to mean that "he had for years been paying returns to certain investors out of the principal received from other, different, investors," said the complaint, which did not identify the investors impacted by the scheme.

Cacioppi said one of the employees told him that Madoff was "cryptic" about the firm's investment advisory business and kept its financial statements locked up. The FBI agent said another employee told him that Madoff last week said clients had asked for about $7 billion in redemptions and he was struggling to meet those obligations but thought he could do so.

Cacioppi said two senior Madoff employees told him that Madoff said during the Wednesday meeting that he planned to surrender to authorities in a week but first wanted to distribute $200 million to $300 million he had left to certain selected employees, family and friends.

Cacioppi said he and another FBI agent arrived Thursday at Madoff's apartment, where Madoff invited them in and acknowledged knowing why they were there.

"Madoff stated, in substance, that he had personally traded and lost money for institutional clients, and that it was all his fault," Cacioppi said.

The agent wrote that Madoff said he had "paid investors with money that wasn't there" and that he was broke and insolvent and had decided that "it could not go on" and that he expected to go to jail.

Defense lawyer Dan Horwitz called Madoff "a person of integrity" and said he intends to fight the charge.

If convicted, Madoff could face up to 20 years in prison and a maximum fine of $5 million.

Bernard L. Madoff Investment Securities LLC ranks among the top 1 percent of U.S. securities firms, according to the company's Web site.

In 2001, Barron's reported that Madoff's firm was one of the three top market makers in Nasdaq stocks and the third-largest firm matching buyers and sellers of securities on the New York Stock Exchange.

Shortly after leaving law school, Madoff founded his firm in 1960. It was one of five broker-dealers most closely involved in developing the Nasdaq Stock Market, where he served as a member of the board of governors in the 1980s and as chairman of the board of directors.

In the 1990s, Madoff was viewed as a maverick. He angered leaders of the New York and American stock exchanges by taking away some of their business by paying brokerage firms a penny a share to route orders through his system.

Sources :

- Ex-Nasdaq chairman arrested on $50B fraud charge | By LARRY NEUMEISTER, Associated Press Writer.

Saturday, December 13, 2008 | 2 Comments

Sterling Fall:How the Weak Pound is Affecting Travellers

With the pound falling to a record low against many of the world's major currencies, exchange rates will have a big influence on where we travel in 2009.

Destinations where currency has slipped at the same rate as the pound - such as Cape Town in South Africa - may see an increase in British visitors Photo: REUTERS

Destinations where currency has slipped at the same rate as the pound - such as Cape Town in South Africa - may see an increase in British visitors Photo: REUTERSFew holidaymakers used to take much notice of fluctuating exchange rates. Historically, the pound has always hovered around $1.6 and about 1.4 euros. Thailand, South America, Africa and the Far East have traditionally been seen as "good value". But with the pound in freefall against the world's major currencies – it fell to an all-time low against the euro today – all that has changed.

Some analysts predict that next year we could see parity between the pound and the euro and even the dollar. More than ever before, exchange rates are influencing holiday decisions. A survey of Telegraph readers last month found that nearly half admitted that exchange rates influence their choice of destinations.

Destinations

With NatWest Bank now offering travellers a rate of 1.08 euros for every pound, compared with 1.32 euros a year ago, popular eurozone destinations such as Spain and Greece have seen a sharp decline in British visitors. By comparison, Turkey where the pound has only fallen by five per cent, enjoyed its best ever summer. Iceland has also seen a surge in British visitors, with prices down by a third due to the collapse of the krona.

The slide of the pound against the dollar – from around $2 at this time last year to just $1.39 today – affects stays in the US as well as several Caribbean and African countries whose currencies are pegged to the dollar.

Bookings for ski trips to the US have already fallen this year as travellers head either to the better-value Canadian Rockies, where the pound has only recently fallen against the Canadian dollar (from $1.93 to $1.72), or to the European Alps.

For those looking for winter sun, popular destinations such as Barbados, Dubai and Egypt, will appear up to a third more expensive this year. Instead it is long-haul destinations such as South Africa, where prices are five per cent cheaper, New Zealand where the pound has stayed level and Australia, where it is dropped by less than 10 per cent, that offer the best value.

The high cost of foreign travel is expected to be a boon for domestic tourism next summer. Hoseasons, one of the largest UK operators has already reported a 20 per cent rise in bookings for 2009.

Package holidays

The rising price of the euro and the dollar has prompted many Britons to return to traditional all-inclusive package holidays. These are easier to budget for and they offer financial protection (which has grown in importance following the collapse of dozens of airlines).

However, package prices will increase next year. Tour operators are currently securing rooms for next at higher rates than previously for many of the popular destinations and will be forced to pass these extra cost on. The collapse of the tour operator XL this summer and the mergers of Britain's four leading operators (Thomson with First Choice and Thomas Cook with MyTravel) has reduced competition, enabling companies to keep their prices up by reducing the number of summer holidays they will offer in 2009.

Flights

Despite the price of aviation fuel falling by more than third since last year, fuel surcharges still remain higher than this time last year. BA's long-haul fuel surcharge is £192 for a return flight compared with £116 return in December 2007.

This week the head of International Air Transport Association (IATA) eported that air fares could fall by up to five per cent next year, but mainly on competitive routes to the US, Australia and Dubai. In recent weeks, airlines have been cutting services, which has reduced the competition on many short-haul routes.

Hotels

According to the annual Hotel Price Index researched by the accommodation website Hotels.com this week, a combination of slight price rises in Europe (two per cent) and the stronger euro has meant that, for British travellers, average room rates in some European destinations have risen by as much as 30 per cent. Geneva showed the biggest increase, with rooms rates up by third between July and September compared with the same period last year.

Over the same period, prices across North America fell by five per cent and four per cent in the Caribbean, although in real terms they would have increased due to the strengthening of the dollar against the pound. In Latin America, prices were down by one per cent and they remained static in Asia. British hotels have cut their rates for the first time in four years.

Cruises

It is overcapacity, rather than poor exchange rates, that is the main problem for cruise lines. With 40 more ships boasting more than 50,000 extra berths set to be launched by 2012, cruise lines will continue to struggle to fill their ships. This week, the Telegraph’s cruising correspondent, Jane Archer, was on a Windstar cruise which was less than a quarter full and staff outnumbered passengers by nearly three to one.

As a result there are some great deals. Several cruise lines are selling off cruises this winter for as little as a quarter of the brochure price, while others have cut their fuel surcharges in line with the drop in oil prices. Despite these savings, passengers on Mediterranean, US and Caribbean cruises will continue to feel the pinch when they step off the boat.

Holiday spending

A survey today by the Post Office showed the extent of price rises in Eurozone countries – with the price of holiday essentials rising, on average, by 23 per cent compared with last year.

The average price of a cup of coffee in France has risen from £1.55 to £1.86, while a three-course evening meal in Greece (including wine) has risen from £34 to nearly £42. Similar rises have been registered in Dubai, the US and the Caribbean.

Sources :

- How the weak pound is affecting travellers | By Charles Starmer-Smith Last Updated: 4:38PM GMT 10 Dec 2008.

- Value of pound falls to 28-year low | By Robert Winnett, Deputy Political Editor Last Updated: 9:03AM GMT 11 Dec 2008.

Saturday, December 13, 2008 | 0 Comments

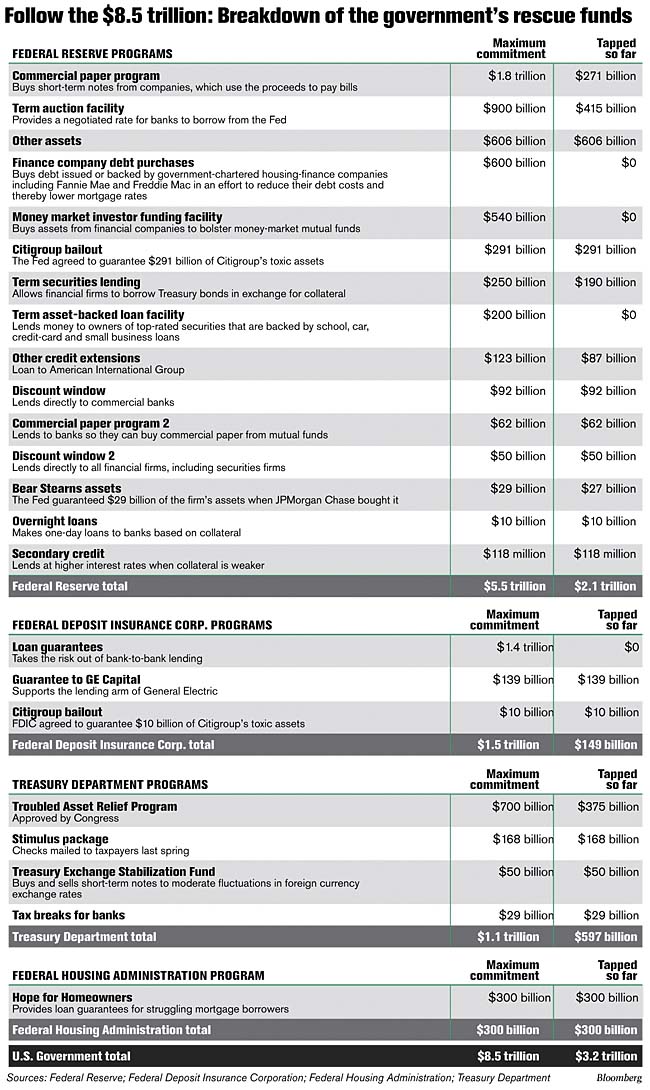

US Bailout Hits $8.5 Trillion

Key dates in the federal government's campaign to alleviate the economic crisis:

- March 11: The Federal Reserve announces a rescue package to provide up to $200 billion in loans to banks and investment houses and let them put up risky mortgage-backed securities as collateral.

- March 16: The Fed provides a $29 billion loan to JPMorgan Chase & Co. as part of its purchase of investment bank Bear Stearns.

- July 30: President Bush signs a housing bill including $300 billion in new loan authority for the government to back cheaper mortgages for troubled homeowners.

- Sept. 7: The Treasury takes over mortgage giants Fannie Mae and Freddie Mac, putting them into a conservatorship and pledging up to $200 billion to back their assets.

- Sept. 16: The Fed injects $85 billion into the failing American International Group, one of the world's largest insurance companies.

- Sept. 16: The Fed pumps $70 billion more into the nation's financial system to help ease credit stresses.

- Sept. 19: The Treasury temporarily guarantees money market funds against losses up to $50 billion.

- Oct. 3: President Bush signs the $700 billion economic bailout package. Treasury Secretary Henry Paulson says the money will be used to buy distressed mortgage-related securities from banks.

- Oct. 6: The Fed increases a short-term loan program, saying it is boosting short-term lending to banks to $150 billion.

- Oct. 7: The Fed says it will start buying unsecured short-term debt from companies, and says that up to $1.3 trillion of the debt may qualify for the program.

- Oct. 8: The Fed agrees to lend AIG $37.8 billion more, bringing total to about $123 billion.

- Oct. 14: The Treasury says it will use $250 billion of the $700 billion bailout to inject capital into the banks, with $125 billion provided to nine of the largest.

- Oct. 14: The FDIC says it will temporarily guarantee up to a total of $1.4 trillion in loans between banks.

- Oct. 21: The Fed says it will provide up to $540 billion in financing to provide liquidity for money market mutual funds.

- Nov. 10: The Treasury and Fed replace the two loans provided to AIG with a $150 billion aid package that includes an infusion of $40 billion from the government's bailout fund.

- Nov. 12: Paulson says the government will not buy distressed mortgage-related assets, but instead will concentrate on injecting capital into banks.

- Nov. 17: Treasury says it has provided $33.6 billion in capital to another 21 banks. So far, the government has invested $158.6 billion in 30 banks.

- Sunday: The Treasury says it will invest $20 billion in Citigroup Inc., on top of $25 billion provided Oct. 14. The Treasury, Fed and FDIC also pledge to backstop large losses Citigroup might absorb on $306 billion in real estate-related assets.

- Tuesday: The Fed says it will purchase up to $600 billion more in mortgage-related assets and will lend up to $200 billion to the holders of securities backed by various types of consumer loans.

Sources :

- by Kathleen Pender: Government bailout hits $8.5 trillion

- Associated Press

- Conquer The Wallstreet: Breakdown of US $8.5 trillion of the government rescue packages

Saturday, December 06, 2008 | 0 Comments

Crisis Balance Sheet US $4.28 trillion

Try $4.28 trillion dollars. That's $4,284,500,000,000 and more than what was spent on WW II, if adjusted for inflation, based on computations from a variety of estimates and sources (*).

Not only is it a astronomical amount of money, its' a complicated cocktail of budgeted dollars, actual spending, guarantees, loans, swaps and other market mechanisms by the Federal Reserve, the Treasury and other offices of government taken over roughly the last year, based on government data and news releases. Strictly speaking, not every cent is a direct result of what's called the financial crisis, but it is arguably related to it.

Some 68-percent of the sum falls under the Federal Reserve's umbrella, while another 16 percent is the under the Troubled Asset Relief Program, TARP, as defined under the Emergency Economic Stabilization Act, signed into law in early October.

(*) References includ US National Archive, US Dept of Defense, US Bureau of Reclamation, Library of Congress, NASA, Panama Canal Authority, FDIC, Brittanica, WSJ, Time, CNN.com, and a number of other websites.

Sources :

- CNBC : Financial Crisis Tab Already In The Trillions | 18 Nov 2008 | 04:38 PM ET.

Wednesday, November 26, 2008 | 0 Comments

Pirates Halve Ransom Demand for Super-Tanker

Somali pirates, who have been holding Saudi super oil-tanker for nine days, have reportedly halved their ransom demand of $25 million.

While Islamist spokesman Abdirahim Isse Adow said Monday "the middlemen proposed a $15 million ransom figure for the Saudi ship," an Arabic newspaper claimed the hijackers reduced the ransom demand to $12 million.

The Asharq Al-Awsat newspaper, quoting unidentified sources, said that the ransom demand could be cut further, and expected the impasse to be resolved in the next four days.

Adow, whose men wanted to confront the pirates and release the Sirius Star because it was a "Muslim" ship, added that the pirates have taken the ship further out to 100 kilometers off the coast of central Somalia fearing a chase by the Islamist militia.

The Liberian-flagged oil tanker, owned by Saudi Aramco, was seized on November 15 in the Gulf of Aden, southeast of the Keynyan port of Mombasa.

The mammoth tanker is carrying a cargo of two million barrels of oil, with 25 crewmembers on board.

The Saudi owners were negotiating with the pirates over a $25 million ransom, despite pleas from the British and Saudi governments to resist paying the money.

Sources :

RTTNews : Pirates halve ransom demand for super-tanker | 11/24/2008 8:35 AM ET.

Monday, November 24, 2008 | 0 Comments